Image Created by Writer

Gross Profit or Margin

Your gross profit or gross margin is the total sales revenue retained by your business when the expenses of producing your goods are taken away. For example, if your business makes $5000 over a month but spends $3000 on labor and raw materials, your gross margin is $2000, or 40%.

This is a useful metric for understanding your CAC, as profitability relies on your gross margin remaining higher than your average CAC. If the cost of acquiring new customers starts eating into what should be your revenue, you can see it as a warning sign.

On the other hand, if you have a very high gross margin, you may feel confident in investing more funds into acquiring new customers, knowing you will recoup the loss later down the line.

Customer Lifetime Value (CLV)

According to economist Vilfredo Pareto, 20% of a business’s customers should represent up to 80% of total sales. Your customer lifetime value is the metric that shows how this stands up.

You can work out an average CLV by multiplying your customer value by the average customer lifespan. Your customer value is your AOV multiplied by the average number of times a buyer makes that purchase over a given time span. Your customer lifespan is the average number of years a customer continues to buy your products.

For example, let’s say a business is selling skincare products marketed to teens. The average order value is $10, but the average customer will rebuy the product on a monthly basis. This gives a customer value of $120 per annum. If the average then-teenager relies on these products for an average of eight years, this gives a customer a lifetime value of $960.

Spending money on attracting new clients is inevitable – but keeping those clients coming back for more offers consistent revenue at a far lower cost. From mailing lists and loyalty programs to customer service, the cost per interaction with customer will reliably come out lower than the costs associated with gaining new customers.

Customer acquisition cost runs on the assumption that each customer will make a single purchase. By taking a customer’s lifetime value into account alongside CAC, you can understand how much money you’re likely to make long-term for each customer you acquire. This will show you how good an investment your CAC truly is.

How to Reduce Customer Acquisition Cost

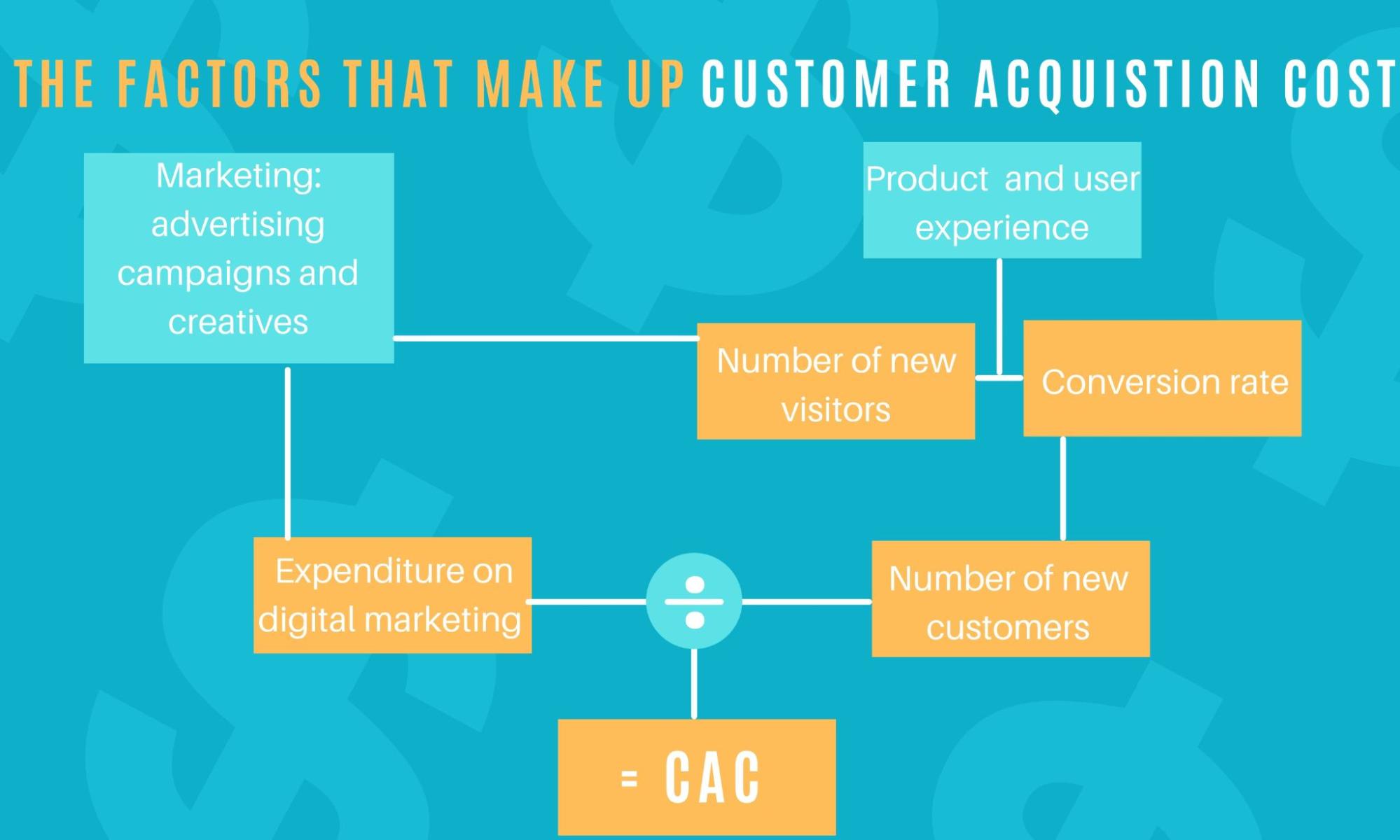

Cost per acquisition is a central metric for any business hoping to grow sustainably. By continually monitoring and analyzing acquisition costs, you can build strong and data-centric strategies to reduce your costs and propel your business to the next level – without breaking the bank.

Reducing CPA can be achieved in multiple ways. You can reduce expenditure on marketing or production costs, or you can increase the number of new customers. In many cases, increasing new customers also increases marketing costs, but there are ways around this. For example, focusing on the user experience can increase conversions from existing site visitors.

In order to achieve this, it’s crucial to have a good handle on your sales and spending data. Take time to transfer all of your digital marketing data onto a single platform for quick and quality analysis going forward.